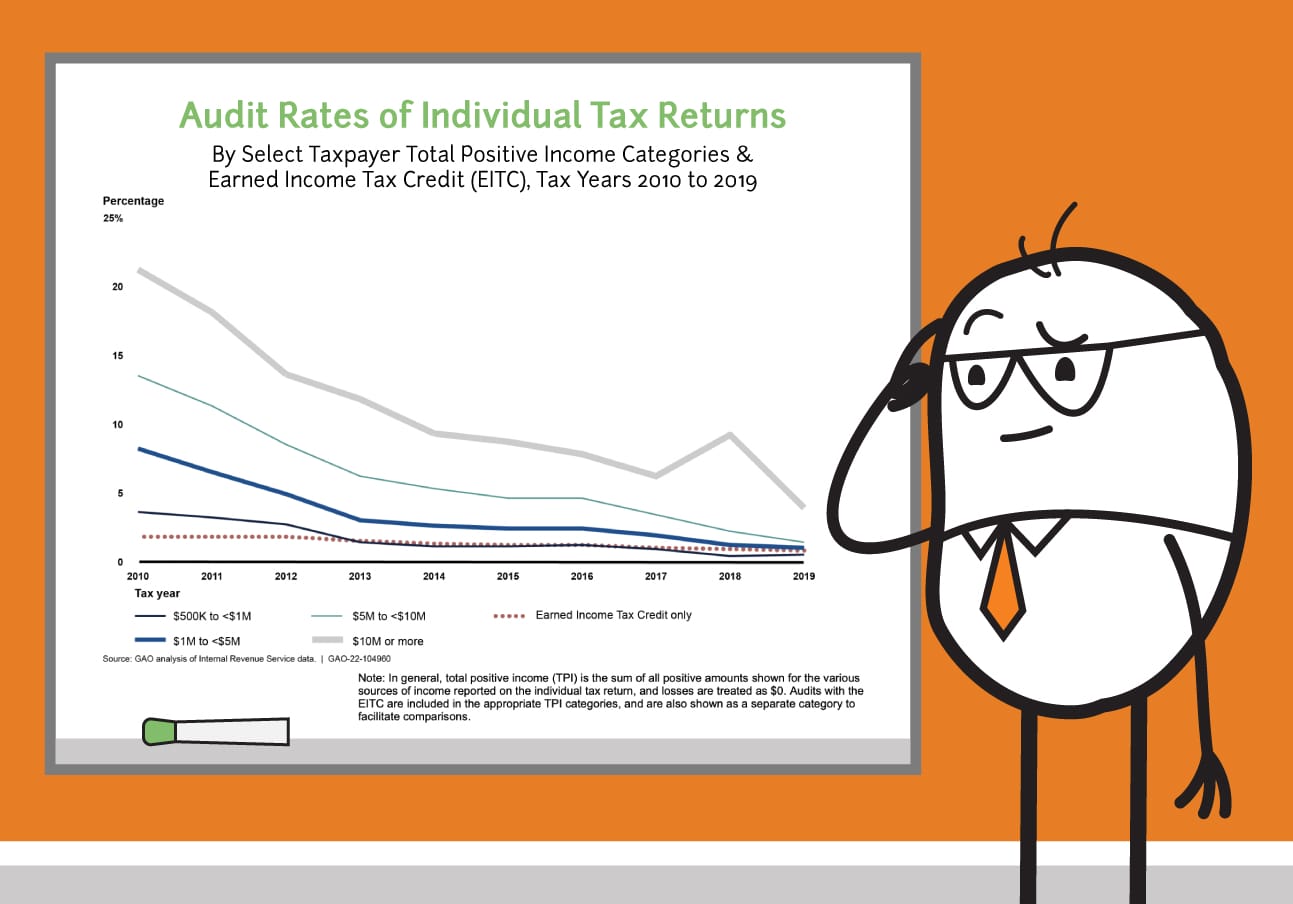

Due to the rising concerns about declining taxpayer compliance and the IRS equitably selecting taxpayers to audit, The Government Accountability Office (GAO) studied the past 10 fiscal years to discover trends that lead to an income audit rate decrease. The Government Accountability Office (GAO) issued its findings in a report on the audit rates of individual tax returns from tax years 2010 to 2019 for all income levels.

Income Audit Report Findings

According to the report, the overall audit rate for these returns decreased from 0.9% to 0.25% between the tax years 2010 to 2019. The IRS attributed this trend to the decreased funding which reduced staffing within their organization. Audit rates decreased the most for taxpayers with incomes of $200,000 and above since the returns were generally more complex and required extensive staff review, thus costing the IRS more labor and time compared to the rates of individuals with an income of $200,000 or less. With less staff, the IRS focused more attention on audits that required less labor and time compared to individuals with incomes above $200,000.

High-Income & Low-Income Taxpayer Income Audit Rate Decrease

IRS officials said that when lower-income taxpayers respond to the IRS with documentation to justify that they do not owe additional taxes, auditors use more hours to review documentation and respond to taxpayers compared to when taxpayers do not provide adequate documentation or do not respond at all, which is common for lower-income taxpayers. When taxpayers provide inadequate documentation or no response, IRS can use automated processes to quickly close these audits with the recommended tax change.

Conversely, for taxpayers with an income of $50,000 and above, IRS spent fewer hours, on average, on no-change audits compared to audits with tax changes. Taxpayers at this income level are more likely to respond to IRS audit notices. IRS officials said that although it takes time to review taxpayer documentation substantiating that the taxpayer owes no additional taxes, auditors can close these no-change audits relatively quickly. In comparison, audits with tax changes can take longer because they commonly have complex tax issues.

The Selection of Audits

Although the audit rates decreased more for higher-income taxpayers, the IRS generally audited them at higher rates compared to lower-income taxpayers. However, the audit rate for taxpayers claiming the Earned Income Tax Credit (EITC) was higher than average. The IRS explained that EITC audits require fewer resources and prevent ineligible taxpayers from receiving the EITC because the IRS conducts qualification audits before issuing taxpayer refunds. As a result, IRS does not need to collect the assessed amounts since it already possesses the tax amounts in question.

According to IRS officials, higher-income audits generally had lower collection rates because they are more likely to involve higher recommended tax amounts that may be abated or more difficult to fully collect. In particular, IRS officials said that, in earlier years, a larger portion of recommended tax changes for higher-income taxpayers was associated with correspondence audits, which had a higher abatement rate and thus reduced collections. They added that the collection rate for audits of taxpayers with incomes of $1 million or above depends on a relatively small number of taxpayers. Therefore, a few large payments can increase the collection rate.

The Nerds Can Assist

Do you have any other questions about tax audits? Connect today to CPA Nerds, and let us help you avoid a potential audit.

Read More

For an in-depth look at the report detailing the overall income audit rate decrease, view the full details released by the Government Accountability Office (GAO) here.