New Federal Reporting Requirements: A Guide for Small Businesses in 2024

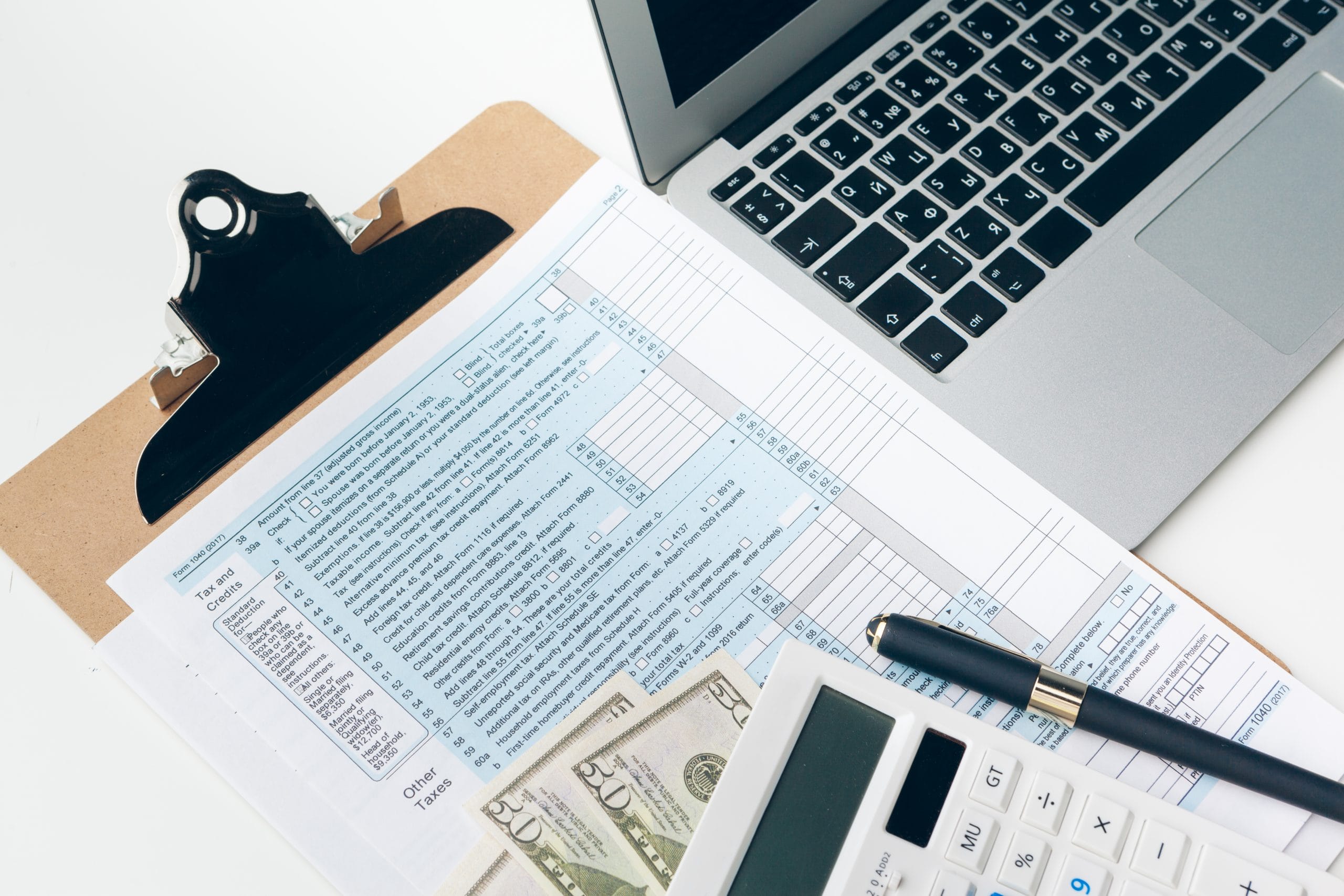

Understanding the FinCEN Reporting Mandate What Small Business Owners Need to Know The year 2024 brings new federal reporting requirements for small businesses across the United States. This mandate, overseen by the Financial Crimes Enforcement Network, commonly referred to as FinCEN, a bureau of the U.S. Department of the Treasury, is aimed at combating financial …