Where’s My Michigan Tax Refund? What To Expect After Filing Taxes

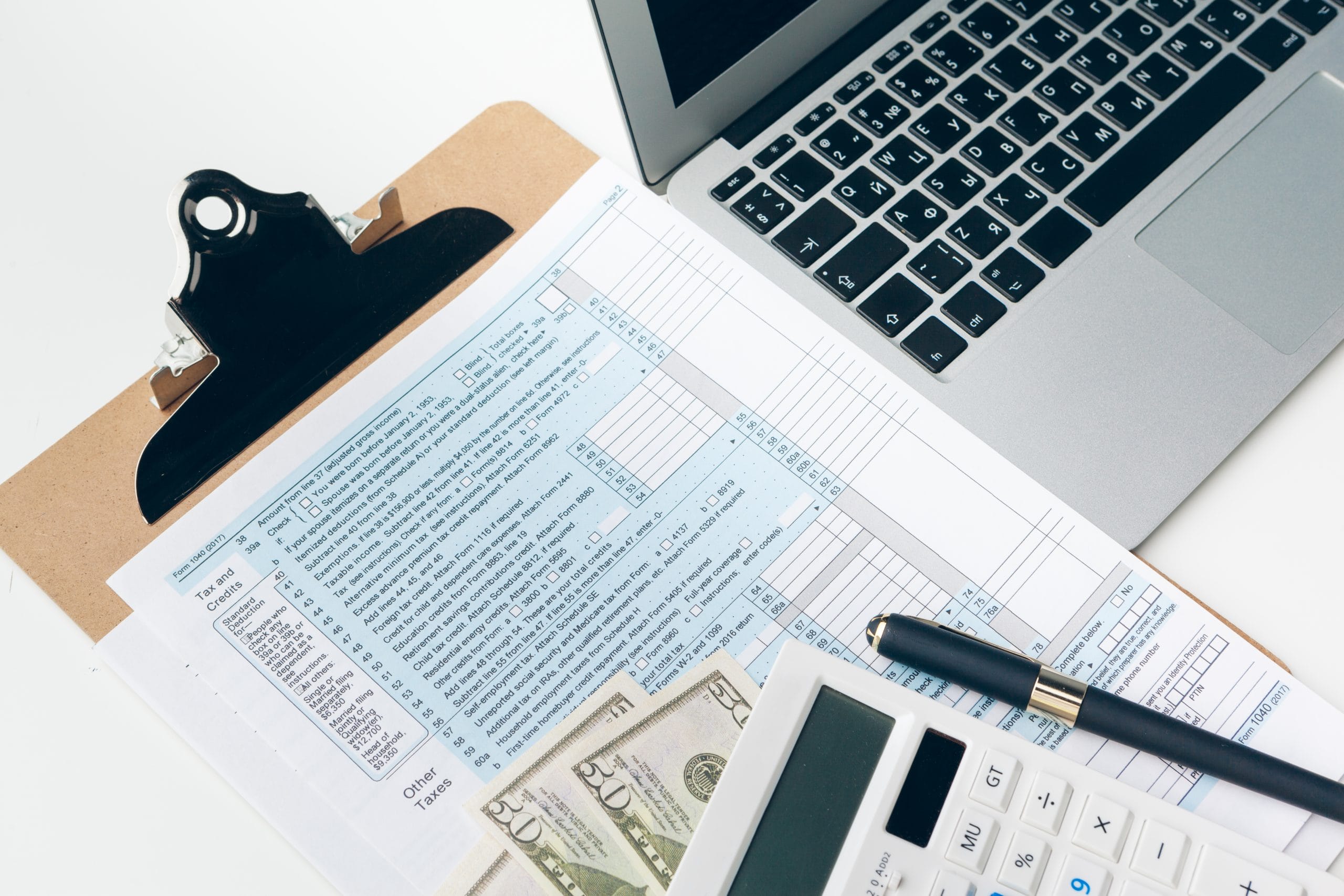

Tax season can be confusing at the best of times, especially when awaiting your Michigan state tax refund. Understanding how the refund process works and what to expect can help ease concerns and set realistic expectations. If you’re wondering where your Michigan tax refund is, how long it will take to receive it, and …